House Republicans unveiled their tax reform plan last week, H.R. 1, the “Tax Cuts and Jobs Act,” which officials hope to pass by Thanksgiving and have the final bill ready for signature by Christmas. However, the bill has a long way to go through the legislative process, with the House Ways and Means Committee initiating the first step by debating and marking up the proposal this week. While it’s unlikely H.R. 1 will become law in its current form, it’s worth understanding what’s in the bill to see where the baseline for tax negotiations will begin. The proposal shows us what House Republican priorities for tax reform are, and sets the tone for the Senate GOP tax proposal, expected to be released this week.

What’s in the bill? Below are the highlights, but a full analysis from the Joint Committee on Taxation (JCT), the official scorekeeper for tax legislation, is available here.

The tax proposal may not be as good as advertised for middle-class families in the long run.

H.R. 1 proposes a sweeping overhaul of the U.S. tax code, including changes in taxation of individuals, repealing the Alternative Minimum Tax (AMT), business tax reform, taxation of foreign income, and for tax-exempt organizations. The Washington Post says in its summary of the JCT analysis that the GOP bill may hurt rather than help the middle class. The bill would “add nearly $1.5 trillion to the debt over the next decade” and on average, families earning $20,000–$40,000 a year and $200,000–$500,000 a year “would pay more in individual income taxes in 2023 and beyond.”

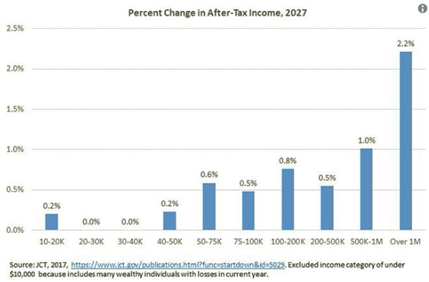

Moreover, middle-class families would also lose “popular tax breaks” like the state and local tax (SALT) deduction, “which may explain why they [would] get higher tax bills.” Many families in high-tax states would likely have higher tax bills under the GOP proposal, which would no longer allow sales and income tax deductions and only allow up to $10,000 in property taxes to be deducted from federal taxes. JCT data suggest that overall, millionaires will see the largest benefit in after-tax incomes than any other class over the next decade because of the proposal.

For more analysis on how the proposal affects average middle-class families, read this article and be on the lookout for more JCT reports this month.

The GOP tax proposal is harmful for public schools and local education funding.

There are several tax provisions in the House GOP tax proposal that would affect public education and schools. We’ve highlighted the most important issues that district leaders should be on the lookout for below, but you can find more provisions in our alert from last week.

- The proposal will repeal/cap the state and local tax (SALT) deduction. This provision is by far the most harmful to public education, and would directly affect local funding for public schools. Schools rely on property, sales, income, and other local tax revenues for most of their funding. Taxpayers are more likely to agree to pay for education and other public services if they know they can deduct a portion of what they paid from their federal taxes. However, without the SALT deduction, state and local governments will be pressured to reduce local taxes, which will cut local funding for education. With even less funding available for schools, students will have fewer resources available to boost their chances for success.

Even a partial elimination of the SALT deduction would still significantly restrict state and local government financing for education and other critical public services. The Americans Against Double Taxation coalition, of which ASBO International is a member, issued the following statement: “The partial elimination of SALT–combined with cutting the cap on the mortgage interest deduction in half–will result in a double whammy on homeowners, raising tax bills while diminishing home values. The plan also will result in a backdoor hit to every taxpayer around the country, as it threatens essential public services, such as education, health care, and infrastructure, that are substantially funded through state income and sales taxes. Personal income and sales taxes supply two-thirds of all state revenues.

- The proposal would reform how state and local governments can issue bonds. U.S. News reports that the GOP bill would “put an end to tax-exempt debt issuance by state and local government for an array of health care, education, and economic development financing.” The JCT analysis of the Republican tax proposal says that the bill would do the following for bonds issued after December 31, 2017:

Would repeal the tax-exempt status from qualified private activity bonds (PABs), making the interest taxable. JCT says, “Interest on any private activity bond is includible in the gross income of the taxpayer.” The House GOP proposal summary says, “interest on newly issued PABs would be included in income and thus subject to tax.” This change would increase federal revenues by $39 billion over nine years.

Would repeal the tax-exempt status on advance refunding bonds, making the interest taxable. JCT says, “The proposal repeals the exclusion from gross income for interest on a bond issued to advance refund another bond.” The House GOP proposal summary says, “Interest on advance refunding bonds (i.e., refunding bonds issued more than 90 days before the redemption of the refunded bonds) would be taxable. Interest on current refunding bonds would continue to be tax-exempt.” This change would increase federal revenues by more than $17 billion for over nine years.

Would no longer allow bond issuers to issue tax-credit bonds, including tax-credit qualified zone academy bonds (QZABs) and qualified school construction bonds (QSCBs). “The proposal prospectively repeals authority to issue tax-credit bonds.” The House GOP proposal summary says, “The rules relating to tax credit bonds generally would be repealed. Holders and issuers would continue receiving tax credits and payments for tax credit bonds already issued, but no new bonds could be issued.” This change would reduce federal expenses by $500 million for nine years.

What does this mean for school districts?

School districts can currently issue tax-exempt government bonds and qualified PABs (public schools rely on the former, and private/charter schools often rely on the latter) to help finance school facility construction and renovation projects, providing low-risk, stable, and secure investment options for investors. Although their yield is lower than corporate bonds, the interest income that investors receive from these bonds is free from federal taxes. However, by repealing their tax-exempt status, they lose their appeal for investors, who could invest in higher-yield corporate bonds if they’re going to have to pay taxes on interest income anyway.

Repealing the tax incentives from these bonds will raise the cost of borrowing for school districts, since bondholders are more willing to lend at a cheaper, low-interest rate if their interest income is tax-exempt. If the interest is no longer tax-exempt, investors will offer bids at higher interest rates, thus forcing school districts to rely on taxable, higher-interest-rate financing to fund facility projects. However, many state and local laws limit the number of bonds a school district can issue and the amount of debt the district can incur, rendering higher-interest and higher-cost financing options unfeasible for many school districts. Either school facility projects will be delayed or cancelled altogether, or districts will have to find alternate sources of revenue to fund them.

As for advance refunding bonds, school districts rely on these bonds as a way to refinance their debt, save money, and reissue bonds to pay off outstanding debt at a lower interest rate. While districts will still be able to advance refund bonds, the interest on them will no longer be tax-exempt. Again, by making the bonds’ interest income for investors taxable, it increases the cost of borrowing because investors will lend at cheaper interest rates only if their income is tax-free. Advance refunding bonds will be more expensive for districts, as investors bid on them at higher interest rates than if they were tax-exempt, reducing the amount of savings the school district can capture if they refinance their debt. Only current refunding bonds would remain tax-exempt, making it more difficult for districts to leverage advance refunding bonds for refinancing, thus forcing them to pay higher interest payments in the long run if they can’t easily take advantage of falling interest rates.

Finally, school districts will have even fewer financing tools/options available, as the tax proposal would prohibit districts from issuing tax-credit bonds, including tax-credit QZABs and QSCBs, which are cost-effective financing options since these bonds generally don’t bear interest. Instead, they provide bondholders with a tax credit they can claim as a federal subsidy in lieu of tax exemption on interest income on their federal tax bill. But, under this proposal, districts will no longer be able to issue tax-credit QZABs or QSCBs, tax-exempt advance refunding bonds, or tax-exempt qualified PABs, removing many of the tools at districts’ disposal for financing school facility projects and refinancing outstanding debt.

How can you advocate on this issue?

Consider joining ASBO International in opposing the harmful tax provisions to education in the House GOP proposal by contacting your representatives. Urge your officials to vote NO on H.R. 1 and support a tax plan that supports and invests in education. Also, submit your thoughts on the tax proposal to House Democratic Whip, Rep. Steny Hoyer, who is collecting public feedback online to share with his Congressional peers.